All statements on this website are made without prejudice. Please check with a Certified Public Accountant (CPA) that the information below is current and correct. If you need to find a CPA then please check out the Email List of Accountants

USA Income Tax Regulations

As adults, one thing that intimidates people the most is tax. In theory, tax is a price you pay to the government for using and maintaining public property like roads, government schemes, policing, etc. But, it is very complicated to understand how much you have to pay and to whom. And also if there are any caveats to the whole process of calculating and paying.

I. What kind of income is taxable in the United States?

In principle, a United States resident’s income is taxed in the same way as a United States citizen. If you live in the United States, you must disclose every income you make. This includes interests, dividends, salaries, or other forms of payment for work, as well as earnings from rental property or royalties, on your tax filing. Regardless of whether you received these sums domestically or abroad, you must disclose them. In short, you don’t have to be a US citizen to be taxed. Also, you don’t need to have ‘worked’ or provided a service for you to be taxed. Passive income is taxed as well. To get a detailed overview of this, go to section 4 of this article.

II. What is taxable income?

The part of your money that gets taxed is called taxable income. It is, in the government’s eyes, what you make per year. Based on this figure, the government levies a certain tax percentage on your income. The Internal Revenue Service (IRS) utilizes your adjusted gross income (AGI) amount to calculate your annual income tax due. It is determined by deducting specific adjustments from gross revenue, including company costs, interest on student loan costs, and other expenses. A taxpayer’s tax liability is calculated by deducting reductions from their adjusted gross income (AGI).

III. What are deductions?

Deductions are expenses that are subtracted from your total income or revenue to calculate the amount you will be taxed on.

The IRS gives individual taxpayers the choice between claiming the standard deduction and a number of item-based deductions when it comes to deductions.

Loan interest, healthcare costs over a certain amount (7.5% of your Annual Gross Income), and a variety of other costs are also eligible for itemized deductions.

Businesses do not immediately declare their revenue as taxable income when they pay their taxes. Instead, they determine their company income by deducting their business expenditures from their sales. After that, they take deductions out to determine their taxable income.

Are deductions applicable to US residents?

Yes, deductions are applicable to you if you have been a US resident for the entire tax year (1st January to 31st December). You don’t have to be a US citizen to get tax deductions. This also applies if your income is worldwide. If you live in the US, no matter where in the world your revenue comes from, you must declare it to the IRS.

IV. What are the sources of taxable income?

You will find a list of taxable income and exemptions on the IRS website.

a. Business profits

If you run a business and you make a profit off of it, you will be liable to pay tax. This applies to everything related to a business or investment-type activity. If you receive rental income on properties, dividends on a share, or even something like owning a part of your family business, it is taxable. You must declare every income you have inside or outside of your main day job. However, even within these types of income streams, you can add itemized deductions. For example, if you use a property management service to maintain your rental income, the price of property management can be reduced from the original income. This can help you save money on taxes. Check these details with your Certified Public Accountant (CPA)

b. Employee Salaries

This is the most common type of income, where you are an employee and you earn a certain monthly compensation for your services. This includes salary, paychecks, tips, bonuses, and royalties. Your W-2, which the employer mails to you, details the revenue for you. Any eligible tax deductions, including those for Social Security, Medicare, and 401(k) deposits, are also listed on this page.

The IRS states that everyone who gives childcare services- whether it be in their own households or anywhere else- must declare. This declared money they are paid is taxable income. This law also holds true for any payment you get for babysitting.

You must also account for the value of any fringe benefits you get from your workplace, a director, a partner, or another third party.

c. Partnerships

A legal agreement between two or more persons to run a company and split the earnings is called a partnership.

Partnership arrangements come in many different forms. One type of business where partners may have minimal responsibility is a partnership where all participants share earnings and obligations evenly. Additionally, there is the so-called “passive partner,” when one party does not participate in the daily management of the company. Any income made through such partnerships is also taxable.

Although partnership organizations are not subject to taxation by the IRS, all revenue, deductions, and losses resulting from these corporations are passed onto the contracting parties. The partnership doesn’t pay taxes as a result. Any pass-throughs must be disclosed on your annual tax return if you are a partner. Even if the pass-through does not directly affect you, this must nonetheless happen.

d. Royalties

If you are an artist or intellectual property owner, you might be eligible for this. Royalties earned on copyrights, patents, trademarks, etc need to be disclosed in your tax filings. This also applies to you if you earn in oil, gas, and mineral properties.

e. Barters

If you receive a product or service in return for your work or product, it is called a barter system. Even in these exchanges where you didn’t receive any actual money, you must disclose the value of the service/product you received in return.

f. Cryptocurrency

If you make any money trading or selling cryptocurrencies or NFTs, you must declare that income too.

V. Who do you pay tax to, and when?

In the United States, you would pay your taxes to the IRS (Internal Revenue Service) and you must do so by the 15th of April of every year. In case you are a U.S. resident, and you are not in the country on 15th April, you get an automatic extension to 15th June.

VI. Filing status

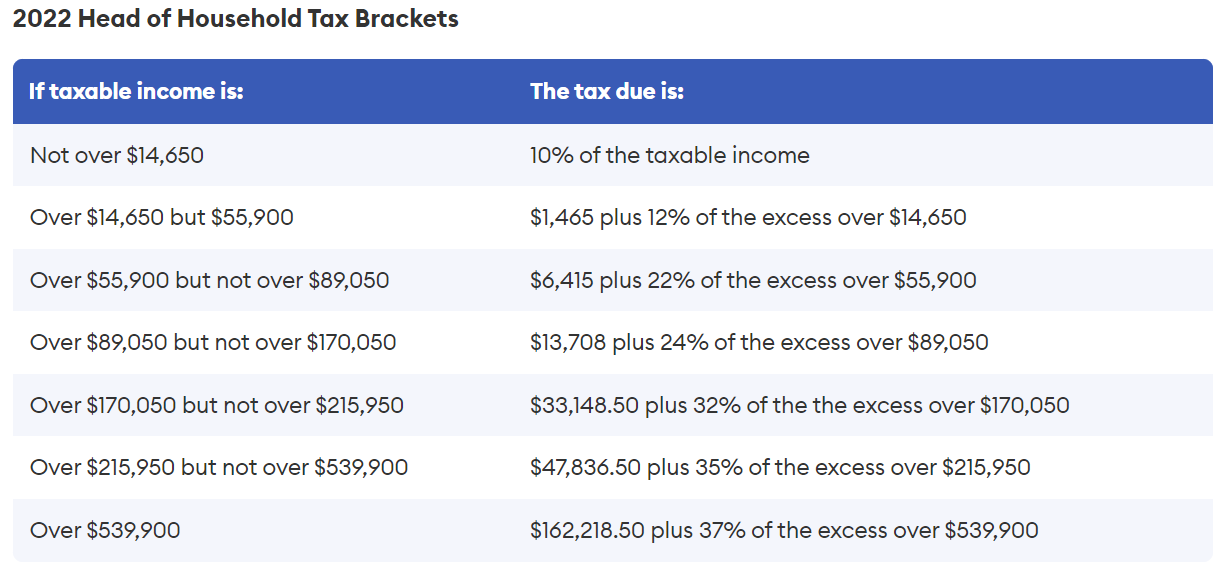

You or your Accountant can either file as a single filer or file for taxes jointly with your spouse. You can also file under the Head of Household bracket if you pay more than half of the support and housing costs. Even if you are married, you will still have to declare if you are filing jointly or separately. This will put you in two different tax brackets for married individuals (as shown below).

VII. Determine your AGI (Annual Gross Income)

Once you or your Certified Public Accountant (CPA) have all your income documents sorted and organized, you will now calculate your Annual Gross Income. To do that, you must deduct the standard deduction rates or do an itemized deduction on your income. Once you have subtracted your costs, you can declare your AGI.

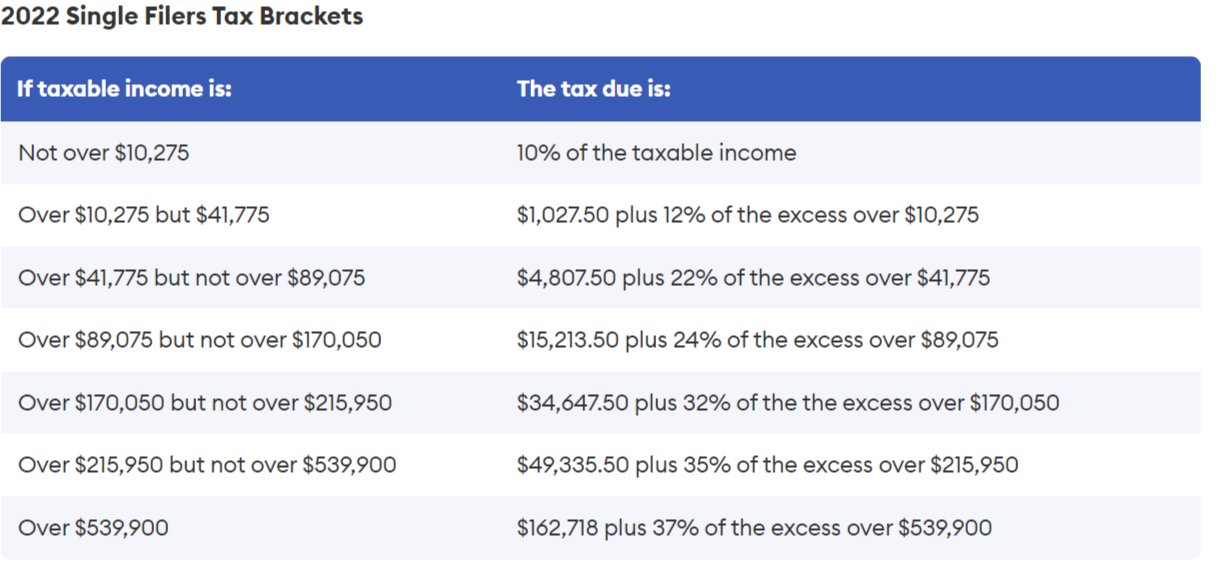

Based on your AGI, you will be taxed in the following manner if your taxes are due on 15th April 2023.

VIII. Calculate your tax based on your tax bracket

Source: Forbes Advisor

Finding a CPA to assess your taxable income

Finding a CPA through traditional methods is a challenge now. In the digital era, finding an accountant through word-of-mouth recommendations is not going to be beneficial at all. Instead, finding a comprehensive list of possible CPAs is the way to go.. Every CPA in a directory is a potential assistant to your business.

Who needs an Accountants Email List?

The range of businesses that may require an Accountants Email List, to asses taxable income is massive. To put it in simpler terms, B2B and SaaS businesses, including Consultancies need the. Advisory businesses providing business advice and solutions to clients, whether other businesses, individuals or even non-profits stand to benefit from having an Email List of Accountants. These lists can be used an unlimited number of times. This means you can use the same contacts for multiple clients.

Sales teams are constantly struggling to meet their targets. They get a headstart and a wider chance of finding success in converting potential clients into real clients with the help of the CPA directory USA. Just imagine the kind of turnover and conversion rate your firm can get with a comprehensive list of thousands of CPAs at your fingertips. These lists can be used repeatedly, and are periodically updated, so you can get the most relevant results when you purchase the low costing directories. Containing thousands of contacts, this list will serve as asource of information about taxable income . They are thus, a great opportunity to boost your business and increase sales massively with little effort.

How to find the best CPA Database?

Upon deciding to try out a CPA database, the next question that comes up is where you can find a reliable list to begin operations. Searching individually for CPAs is going to be an exhaustive task. Thereby making it essential to find a source that conducts all of this research and simply provides a detailed list. Check out online platforms that conduct in-depth research about CPAs, among other professionals, to create a detailed list containing email addresses, phone numbers, and postal addresses of qualified professionals.